Investment Strategies #

Inflation Indexed Bonds #

In 2022, inflation was pretty high, as described by Kiplinger.com:

In July’s price report, falling prices at the gas pump gave consumers a bit of relief, as well as lowering the overall inflation rate to 8.5% from 9.1% in June. A few other price categories showed easing: Appliance prices are coming down, along with sporting goods, men’s clothing, car rentals and hotel rates. Airfares dropped because of lower fuel costs, and used-car prices edged down. All of these were enough to bring down non-energy, non-food price increases to a moderate level in July.

This led to a very high rate of almost 10% for Series I Savings Bonds. This is amazing for a bond and seems like a no-brainer buy. However, there are some caveats:

- The bond cannot be sold for 1 year.

- If sold before 5 years, you lose the last 3 months of interest.

- You must pay income tax on earnings when the bonds are sold.

- The rate is reindexed to inflation every 6 months, so this return will only come as long as inflation is high.

Kiplinger again:

Inflation is not done yet. Prices continued to rise strongly for basics such as food, rent and new vehicles. There is some evidence that food prices may be moderating after a year’s worth of large monthly increases. But continuing large wage increases at many businesses are likely to keep upward pressure on most prices for some time to come. Expect price inflation at the end of the year to be around 8.0%, down a bit from the peak of 9.1% in June, but still high. Inflation will likely fall to around 3%-4% by the end of next year if the economy slows, as expected.

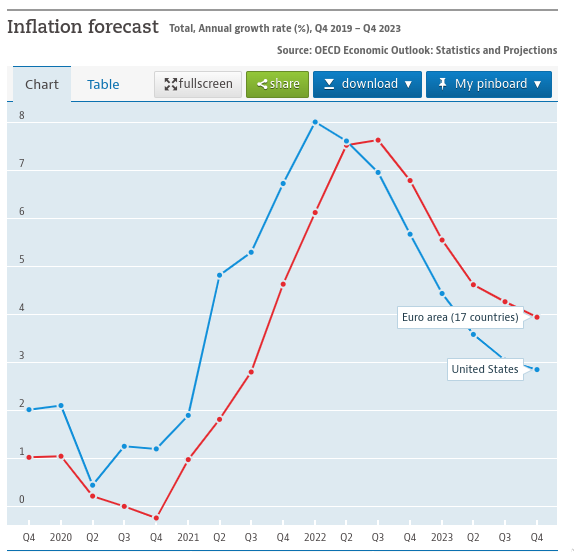

From the OECD:

So it looks like if I buy these bonds now I will probably get a year out of them before I will want to go back into the stock market. With income tax on earnings plus the 3 month interest payback, I’m likely looking at a return of 9.6% for 6 months, then 7% for 6 months, then 0% for 3 months (because I lose the last 3 months), or 6.64% interest. After a ~35% tax (I expect to sell the rest of my investments only when my income and therefore tax rate is much lower), this ends up being 4.32%.

This is much better than the 0% rate I am getting on the $5-10k I keep in my bank account (I know, I live dangerously…), but at the cost of liquidity, especially for the first year. It’s not really an emergency fund if you can’t withdraw it.

I’m not convinced that this rate will beat the stock market overall in the next year though.

So if I’m not using the bonds as an emergency fund, it comes down to: do I think that the market will grow less than ~4.5% in the next year? For me the answer is no right now.

Context #

https://totalrealreturns.com/ gives a good visualization of returns and volatility for different investments.

Stock options #

The Value Factor #

Investment returns can theoretically be explained by different factors described here. Total market index funds do not expose you fully to the value factor, which might be useful to do for maximizing returns in the long run. Here are some first steps to do this (that I have yet to follow):

- https://www.pwlcapital.com/wp-content/uploads/2019/03/PWL-WP-Felix-Factor-Investing-with-ETFs_08-2019-Final.pdf

- https://investor.vanguard.com/etf/profile/portfolio/vtv

- https://www.optimizedportfolio.com/ben-felix-model-portfolio/

Efficient Frontiers #

https://www.madfientist.com/unique-risk-minimum-variance-portfolio/

Leverage #

Using leverage (taking loans to buy investments) can be a power way to “time diversify”, as explained in this Ben Felix video.

See also this (crazy?) investment strategy: https://www.reddit.com/r/financialindependence/comments/o7tnm5/my_guide_to_hedgefundies_portfolio_and_why_im_100/

Using loans to make big purchases is generally worth it if you invested in stocks that have a long term expected return higher than the loan rate (which is usually true).

Retirement Finance #

To look at #

The “Barbell” Strategy #

In his books Nassim Taleb describes a strategy where 90% of the portfolio is in a very safe asset like treasury bills and 10% is in very risky investments like risky stock options or early stage startups. It would be cool to see how some concrete instances of this would perform on historical data (with some random way to pick the 10% to avoid hindsight bias).

Note that Taleb himself seems to think that a better plan for retirement is (small) business ownership:

Categories: Investing And Finances